Table of Content

A home equity loan gives you a lump sum of cash, which you pay off with consistent monthly payments in addition to your current mortgage payment. Home equity loans usually have fixed rates and because your home serves as collateral, rates are typically lower than unsecured loans, like credit cards. Home equity loans are also called second mortgages or home equity installment loans. Today’s mortgage rates vary with market conditions, but the rate you’re offered also depends on the riskiness of your financial profile. A lender must assess whether they believe you’ll repay the home equity loan on time.

The guarantee fee of 3 percent would be assessed on the guaranteed portion ($375,000), resulting in a total fee of $11,250. The SBA charges a guarantee fee between 0.25 percent to 3.5 percent of the guaranteed portion of your SBA 7 loan. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

How much home equity loan can I get?

To arrive at a discount rate, we utilized the capital asset pricing model , which resulted in an outturn of 13.28%. The long-term growth rate was estimated at 3.46%, taking into consideration factors including the company’s profit margin, leverage and asset utilization. Using these inputs, a justified P/E ratio of 10.18x was derived, resulting in a price target of $40.47, representing a 23.66% upside from the last closing price of $32.73.

When you’re comparing loans, try using a business loan calculator to see how different rates will affect your monthly payments. Use Bank of America’s auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Traditional home equity loans have a set repayment term, just like conventional mortgages. The borrower makes regular, fixed payments covering both principal and interest. As with any mortgage, if the loan is not paid off, the home could be sold to satisfy the remaining debt. A home equity loan—also known as an equity loan, home equity installment loan, or second mortgage—is a type of consumer debt.

Rate review: How mortgage interest rates have moved

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Old National home equity loans are available in seven states currently. Here are a few of the key advantages and disadvantages of home equity loans.

The additional 5% is considered to be equity, otherwise known as a deposit. JMMBMB for the period ending September, 2015, booked new loans totaling J$5.3B, which represented a growth of J$2.8B, or 34.2%, in that Bank’s loan portfolio. Over the same period, its stock of non-performing loans grew by a mere J$18M, to end the period at J$118M. "Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far," says McBride. "The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades." The average rate for a jumbo mortgage is 6.55 percent, a decrease of 7 basis points over the last seven days.

Example of a Home Equity Loan

She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor. She was previously at Dow Jones MarketWatch, on the housing market and financial markets beats. Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire. Keep in mind that your overall debt will be factored into your debt-to-income ratio , which can affect your interest rate and eligibility for your new mortgage. Barita makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or completeness of the information presented.

You build up your home equity by making consistent monthly mortgage payments over the years. Unless otherwise specified, all advertised offers and terms and conditions of accounts and services are subject to change at any time without notice. After an account is opened or service begins, it is subject to its features, conditions and terms, which are subject to change at any time in accordance with applicable laws and agreements. M&T CHOICEquity is only available in Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Vermont, Virginia, Washington, DC, and West Virginia. All loans and lines of credit are subject to credit approval.

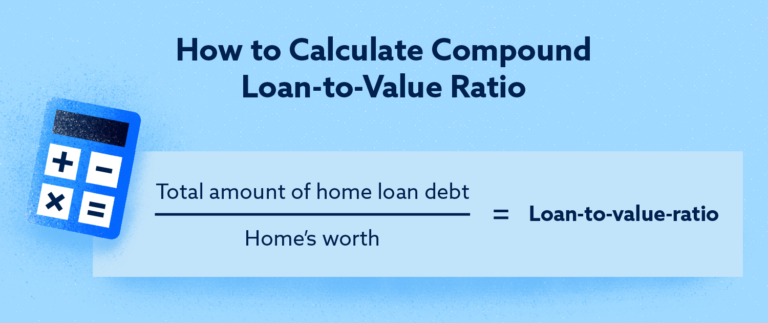

How much can you borrow with a home equity loan?

It gives you access to affordable loans and insurance brokering, so you can drive away with a new or used car. Potential home buyers need a mortgage pre-qualification letter from a mortgage lender to engage a real estate agent to locate a property. Your home’s equity is essentially the portion of your home that you ‘own’, that is, the amount of your home's current value that is free and clear from a mortgage. In Mark’s case, his home is worth J$15 million and his mortgage balance is J$10 million, so his equity is J$5 million. A home equity loan or second mortgage uses the equity in your home, as the collateral.

At the current average rate, you'll pay $627.47 per month in principal and interest for every $100,000 you borrow. At the current average rate, you'll pay $635.36 per month in principal and interest for every $100,000 you borrow. Monthly payments on a 5/1 ARM at 5.46 percent would cost about $565 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loan's terms. At the current average rate, you'll pay principal and interest of $635.36 for every $100k you borrow. The central bank raised rates again at its November meeting — but what comes next is a toss-up.

Before doing something that puts your house in jeopardy, weigh all of your options. BMO’s home equity loans have a higher APR than the national average, but the bank offers a slightly speedier timeline with about 30 days to close. BMO also has a slightly higher CLTV and offers loans as small as $5,000, all of which might put it in the sweet spot for some borrowers. Discover makes its home equity loans available to borrowers with the lowest credit scores among the national lenders surveyed. The interest rate is slightly higher than some competitors, however.

You’ll also pay a loan origination fee that’s a percentage of the total amount you’re borrowing. Access an affordable loan for all your education needs, with flexible repayment plans and competitive rates, by applying for theJMMB Graduate loan. This loan offers relatively low rates and easy payment terms that are manageable and affordable.

However, the currency in which the application is being made is a determining factor, and as such, a USD mortgage attracts a different interest rate from a JMD mortgage. Additionally, the borrower must earn USD to get a mortgage in that currency. The borrower can access maximum financing of 95% of the purchase price or market price, whichever is lower.

If you’re using a home equity loan to “buy, build, or substantially improve” your property, the interest you pay may be tax deductible. This can have a big impact on the affordability of your home equity loan, so be sure to talk to your tax professional up front. You can use a home equity loan to access the equity in your current home to apply toward a down payment on your next home.

A home equity loan can be used to pay off your current mortgage, but this only makes sense if you can get a lower interest rate than your current mortgage. If you can, this will allow you to save on interest and thereby reduce your monthly payment. Legal fees are a part of the closing costs and usually range between 2% and 3% of the selling price, plus GCT. However, many buyers tend to shy away from using a separate lawyer from the seller because legal fees can be expensive. However, it is advised that the home purchaser individuals get their own lawyer. “JMMBMB provides up to 70% of the property’s value for a second mortgage using the home equity loan”, shared Ferguson.

That will increase the value of your property, but they can also be used for other life expenses such as paying off high-interest credit card debt, covering college tuition or building a business. Equity is the difference between your home’s value minus what you owe on your mortgage. Tapping your equity through a home equity loan is just one way to access it, and unlike some types of loans, it will allow you to get the full amount upfront. But to make sure it’s worth the cost to finance, it’s important to first calculate how much you will pay in interest. TD Bank has among the lowest interest rates that are not just an initial teaser rate—it’s for the life of the loan. The 4.49% starting APR is specifically for its 10-year home equity loan.

No comments:

Post a Comment