Table of Content

The general rule of thumb is that your loan payments should not exceed 45% of your income. The opposite is also true; when inflation is low, mortgage rates typically are as well. That drives investors away from mortgage-backed securities , which causes the prices to decrease and yields to increase. When yields move higher, rates become more expensive for borrowers. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

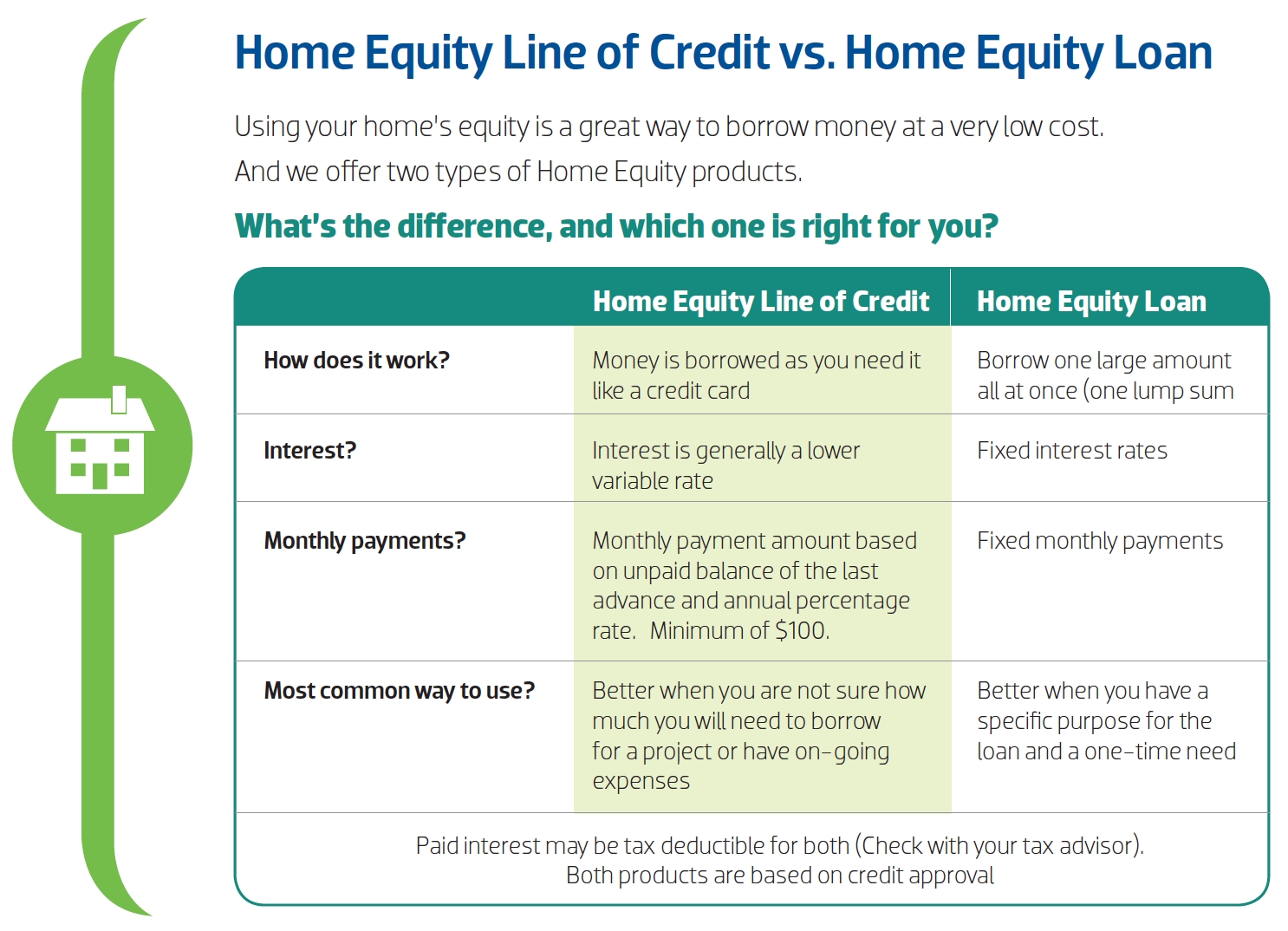

It gives you fast access to cash, with a predictable, long-term repayment schedule. It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling. Other options include a home equity line of credit and a cash-out refinance. The repayment period for the home equity loan can also be shortened, by paying extra towards the principal each month, or making lump sum payments from bonuses, additional earnings or gifts. However, it best to seek expert financial advice as to whether this would be the best financial decision for you at that particular time.

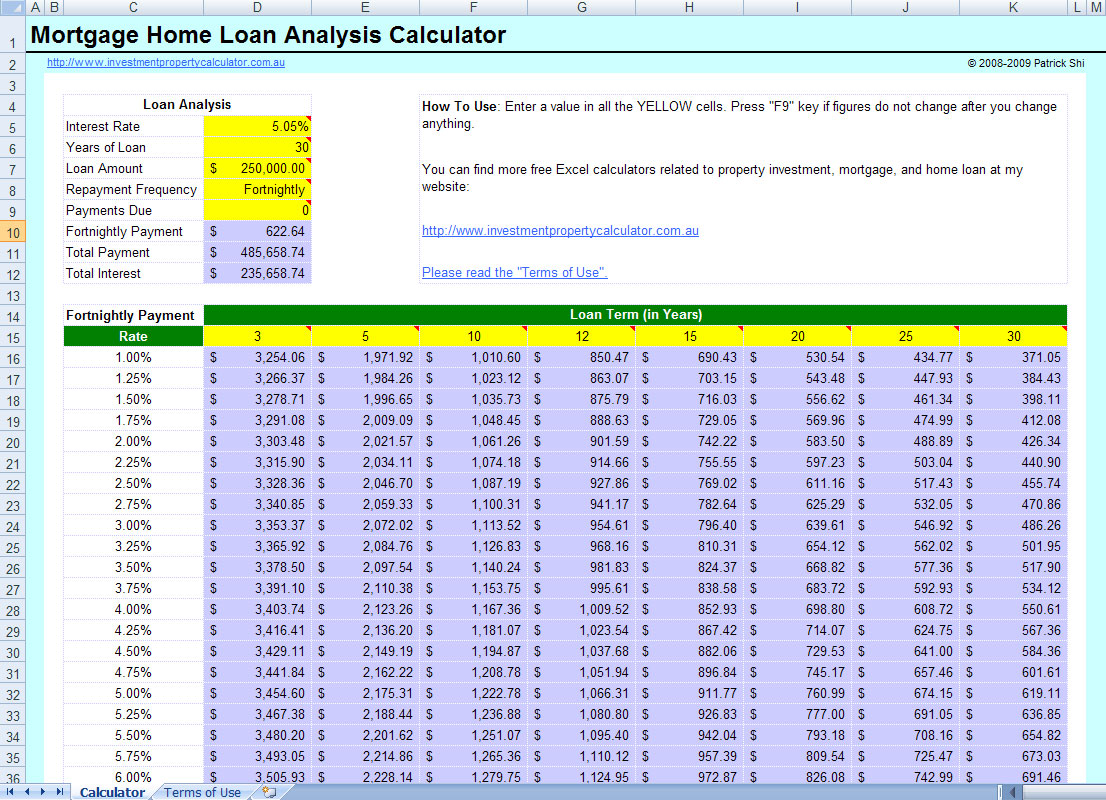

How much mortgage can I afford?

Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home’s current market value and the homeowner’s mortgage balance due. Home equity loans tend to be fixed-rate, while the typical alternative, home equity lines of credit , generally have variable rates. Provides you with a lump sum of cash at a fixed-interest rate. You receive all of your funds upfront and have predictable monthly payments over the lifetime of your loan.

If your business fails and you can't pay back your loan, you could lose your house to foreclosure, which is why there are better alternatives to fund the start of your business. Marc is senior editor at CNET Money, overseeing banking and home equity coverage. He's been a financial writer and editor for more than two decades, working for The Kiplinger Washington Editors, U.S. News & World Report, Bankrate and Dow Jones. Before joining CNET Money, Wojno was Senior Editor of Finance for ZDNet, writing on blockchain, cryptocurrency, financial services, investing and taxes.

What documents does a self-employed person need to present when applying for a mortgage?

We all do our best to ensure that we plan ahead for all our financial needs, but JMMB understands that ‘life happens’; that’s why we offer the JMMB Payroll Bridge, our payday advance loan solution. This unsecured loan is designed for our clients who want to borrow funds on a short-term basis, which can be used between your monthly salary, to cover an unexpected emergency. When determining the amount of mortgage, you can afford, we look at your combined gross salary, as well as the amount that goes towards your existing loans. We then combine any existing loan payments with the proposed mortgage payment, after which we determine if your loan payment exceeds 45% of your income.

If so, then it likely will be unrealistic to expect to be better off when you increase your debt by 25%, plus interest and fees. This could become a slippery slope tobankruptcy andforeclosure. Home equity loan amounts are based on the difference between a home’s current market value and the homeowner’s mortgage balance due. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014.

Loan for Home

But investing in a home can provide you with equity that can be used to help you realise some other dream as your family grows or your lifestyle changes. There are a number of key benefits to home equity loans, including cost, but there are also drawbacks. The interest on a home equity loan is only tax deductible if the loan is used to buy, build, or substantially improve the home that secures the loan. Home equity loans allow homeowners to borrow against the equity in their residence.

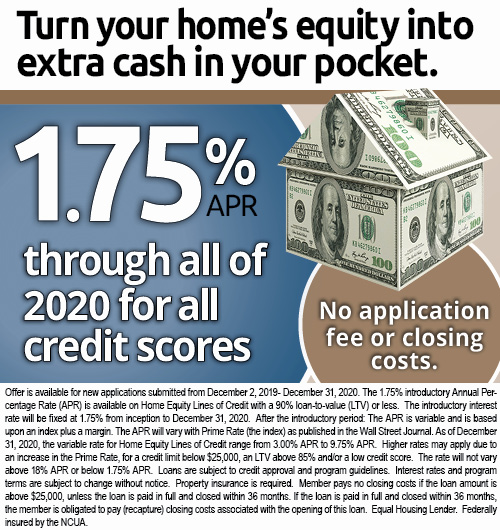

However, you’ll need a high credit score to qualify for that lowest rate. Additionally,TD’s home equity loans aren’t available in all states. Old National’s teaser rate blows away the competition, and the rate that follows the intro rate is also much lower than the average among the lenders reviewed. You can borrow up to 89% of the CLTV ratio on your property. Right now, however, Old National’s home equity loans are only available in Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota and Wisconsin.

The additional 5% is considered to be equity, otherwise known as a deposit. JMMBMB for the period ending September, 2015, booked new loans totaling J$5.3B, which represented a growth of J$2.8B, or 34.2%, in that Bank’s loan portfolio. Over the same period, its stock of non-performing loans grew by a mere J$18M, to end the period at J$118M. "Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far," says McBride. "The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades." The average rate for a jumbo mortgage is 6.55 percent, a decrease of 7 basis points over the last seven days.

The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. A rough rule of thumb is that the amount of equity you have in your home is the home’s value minus any outstanding loans on the property, like your mortgage. You can use our home equity loan calculator for a more precise calculation.

The JMMB Graduate loan offers an unsecured or secured loan, through JMMB Bank, with attractive interest rates. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022. The average rate on a 5/1 ARM is 5.46 percent, sliding 2 basis points since the same time last week. You can save thousands of dollars over the life of your mortgage by getting multiple offers. Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine.

If the person is self-employed and in good health and does not have a physically taxing job, for example, a lawyer, the loan may be calculated to end at age 70. For employed persons, the loan is calculated to end at age 65. For an SBA 7 loan, an SBA lender may charge a prepayment penalty along with closing costs, late payment and referral fees. They can also charge a packaging fee of up to $5,000 for putting together your loan documents for the SBA to review. However, they are prohibited from charging origination fees and application fees. You should avoid using a home equity loan or HELOC to start a business if you have other financing options that don't involve using your home as collateral.

Before doing something that puts your house in jeopardy, weigh all of your options. BMO’s home equity loans have a higher APR than the national average, but the bank offers a slightly speedier timeline with about 30 days to close. BMO also has a slightly higher CLTV and offers loans as small as $5,000, all of which might put it in the sweet spot for some borrowers. Discover makes its home equity loans available to borrowers with the lowest credit scores among the national lenders surveyed. The interest rate is slightly higher than some competitors, however.

No comments:

Post a Comment