Table of Content

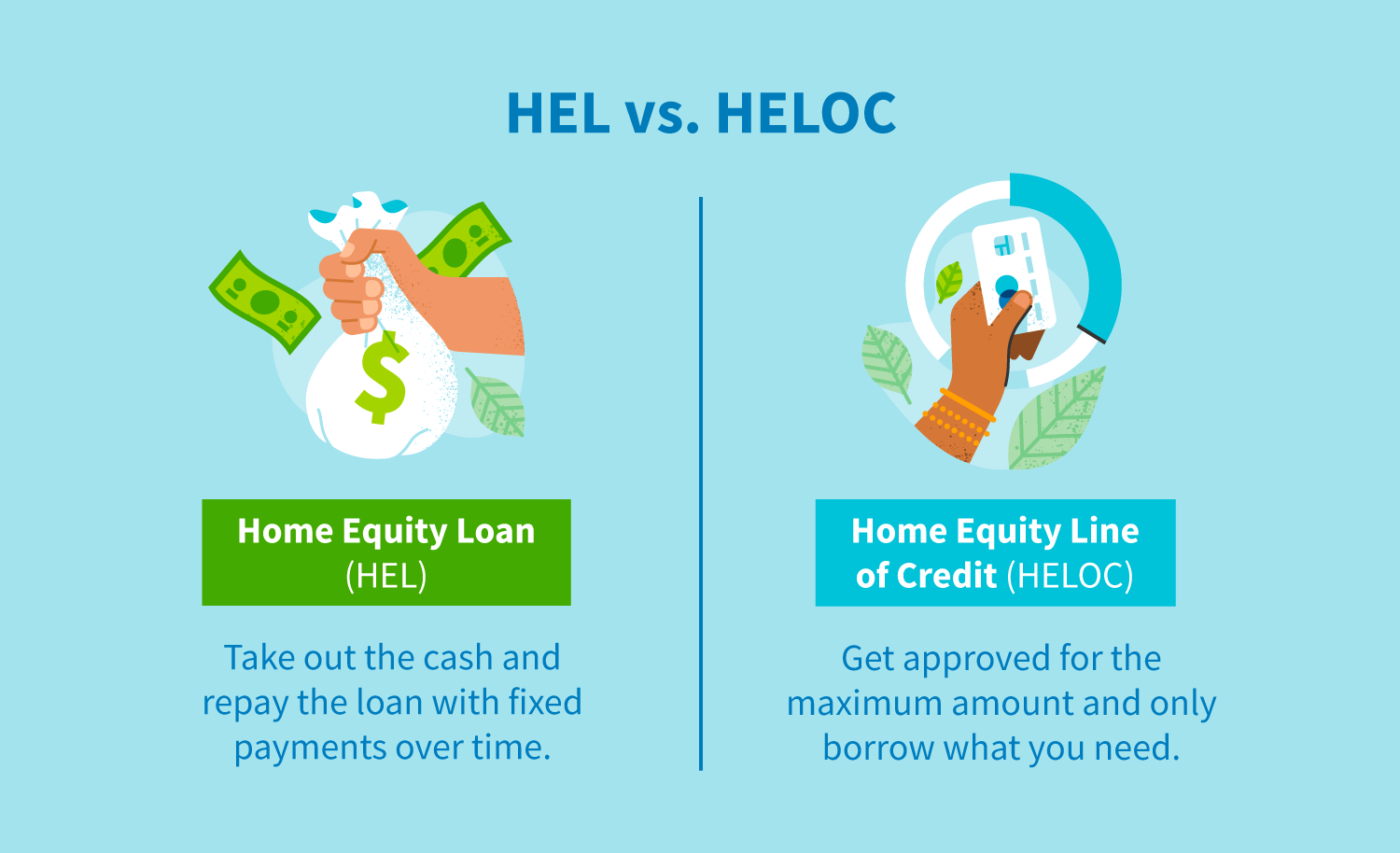

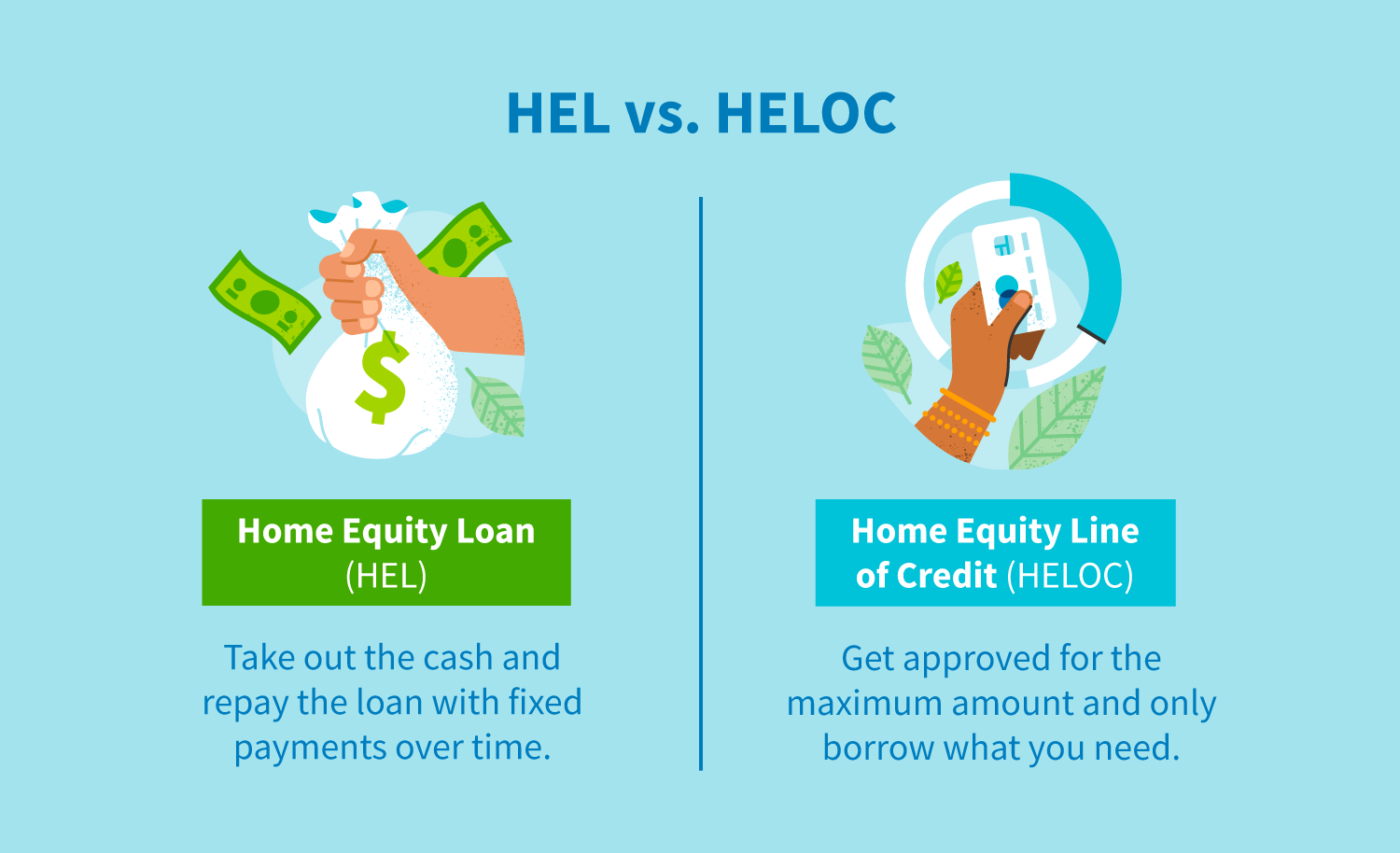

Every month, you’ll make the same payment amount, which is a combined principal and interest payment, until your loan is paid off. In the first half of the loan, you’ll make interest-heavy payments and then principal-heavy payments in the second half — this is called amortization. A home equity loan is a loan you take out against the equity you already have in your home.

As of September 27, the lender had a starting rate of 6.74% for a good-quality borrower, according to a bank representative. BMO offers home equity loans from five to 20 years, with loan amounts starting at $5,000. While there are no closing costs, if you pay your loan in full within 36 months, you may incur a fee for the bank to cover the costs of closing the loan initially. Loan terms range from 10 to 30 years, and there are no origination fees or closing costs.

SBA loan rates 2022

A home equity loan can be used to pay off your current mortgage, but this only makes sense if you can get a lower interest rate than your current mortgage. If you can, this will allow you to save on interest and thereby reduce your monthly payment. Legal fees are a part of the closing costs and usually range between 2% and 3% of the selling price, plus GCT. However, many buyers tend to shy away from using a separate lawyer from the seller because legal fees can be expensive. However, it is advised that the home purchaser individuals get their own lawyer. “JMMBMB provides up to 70% of the property’s value for a second mortgage using the home equity loan”, shared Ferguson.

Estimate your home’s current value by comparing it with recent sales in your area or using an estimate from a site like Zillow or Redfin. Be aware that their value estimates are not always accurate, so adjust your estimate as needed considering the current condition of your home. Then divide the current balance of all loans on your property by your current property value estimate to get your current equity percentage in your home. Home equity loans and HELOCs are both technically second mortgages on your home.

JMMB Group Limited | Equity Analysis

The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. A rough rule of thumb is that the amount of equity you have in your home is the home’s value minus any outstanding loans on the property, like your mortgage. You can use our home equity loan calculator for a more precise calculation.

That being said, the SBA does set a maximum rate lenders can charge. For fixed-rate SBA 7 loans, the maximum is the prime rate plus a set interest rate. For variable-rate loans, the maximum is the base rate plus a set interest rate determined by the loan’s maturity date. As with any business loan, the interest rate you’re offered will vary based on your business’s finances, your creditworthiness, the loan size and term, your industry and other factors. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

What is a home equity loan?

In other words, the interest rate can change intermittently throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for people who expect to sell or refinance before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter. Compared to 15-year loans, lenders charge higher interest rates for 30-year loans because they’re taking on the risk of not being repaid for a longer time span.

The guarantee fee of 3 percent would be assessed on the guaranteed portion ($375,000), resulting in a total fee of $11,250. The SBA charges a guarantee fee between 0.25 percent to 3.5 percent of the guaranteed portion of your SBA 7 loan. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Interest Rate

For loans up to $250,000, closing costs are typically between $300 and $2,000. To arrive at our price target for JMMBGL, a Justified Price to Earnings (P/E) Model was used. Our estimate for the 2023 Financial year-end EPS, considering the challenges to operating profits in the first half of the financial year and seasonality of earnings amounted to $3.98.

To acquire a home equity loan it takes between two and six weeks from application to close, compared to four to six weeks for most other loan closings. The home equity loan closing process is comparatively quick. Most lenders will allow you to borrow up to 80% LTV, but some will let you go as high as 90%.

Do you need a sizable amount of money to cover your children’s education, home improvement, or pay down a hefty credit card balance? Let us explore whether ahome equity loan could be the best choice for you too. JMMB Merchant Bank has significantly expanded its share of the home equity market over the last 3 years, according to JMMBMB’s General Manager - Client Relations, Moya Leiba-Barnes. The average 30-year fixed-refinance rate is 6.43 percent, down 25 basis points from a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 6.90 percent.

Starting APRs are based on borrowers having the best credit profiles and applying for an LTV of 80% or less. It also includes a 0.25% initial rate discount when a borrower sets up automatic payment from an Old National checking account. Keep in mind that each lender charges different amounts for home equity loan fees, and some lump multiple types of fees together. Some lenders even offer no closing cost home equity loans, which prevent upfront costs but can result in a higher interest rate for the life of the loan. A home equity loan functions much like a mortgage where you’re provided a lump sum up at closing and then you begin repayment.

No comments:

Post a Comment